The Gerard O’Neill Voyagers Circle: NSS’ New Society to Honor our Visionary Donors

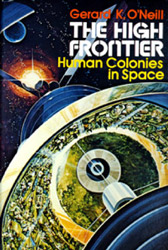

Dr. Gerard K. O’Neill is author of The High Frontier: Human Colonies in Space, first published in 1977. It proposed the construction of giant solar powered cylinders, inside each of which as many as ten million people could live in space. Materials for these colonies would come from mining the Moon and asteroids. Manufacturing space solar power satellites to provide clean, limitless power for the Earth and in space would sustain the colonies, which would be built at the L4 and L5 Lagrangian libration points on the Moon's orbit at equal distances from both the Earth and the Moon. An object placed in orbit around L5 (or L4) will remain there indefinitely without having to expend fuel to keep it in position. The L5 Society, one of the precursors of the National Space Society, was founded around his ideas and from his mailing list. Although Dr. O’Neill never achieved his dream of retiring to one of these colonies, his ideas live on and are within reach of the technology of the near future, with companies such as Made In Space demonstrating additive manufacturing in microgravity and Deep Space Industries preparing to bring materials back to the vicinity of the earth or moon from the asteroids.

Planned Benefits:

Receive a custom blue wool Voyager Circle Jacket, with its NSS logo brass buttons, NSS and Circle logos embroidered on interior pockets, and silk lining depicting beautiful images of O'Neill Cylinder Colonies by Don Davis and Rick Guidice, courtesy of NASA.* Wear it with pride and be recognized and honored at NSS events such as ISDC’s, Chapter Meetings, and Space Development Congresses. Enjoy a special meeting room and the ability to reserve a table for you and your colleagues at ISDC meals.

Receive a custom blue wool Voyager Circle Jacket, with its NSS logo brass buttons, NSS and Circle logos embroidered on interior pockets, and silk lining depicting beautiful images of O'Neill Cylinder Colonies by Don Davis and Rick Guidice, courtesy of NASA.* Wear it with pride and be recognized and honored at NSS events such as ISDC’s, Chapter Meetings, and Space Development Congresses. Enjoy a special meeting room and the ability to reserve a table for you and your colleagues at ISDC meals.

Our Bequests Coordinator will arrange meetings with NSS Leadership at ISDCs or calls at other times so you can discuss your ideas for the Society’s future, and desirable life experiences that NSS might be able to arrange for you and other Circle members (such as visits to NASA or commercial space partner facilities).

*The Blazers are manufactured in batches of 50 or more. The first batch of Blazers were presented at ISDC 2019 and there are some select sizes remaining for immediate shipping to new members. Otherwise, Blazers for new members is targeted for delivery or presentation on or around the dates of future ISDCs.

Entry Requirements:

- A signed, non-binding Letter of Intent to remember NSS in your will, plus a $500 current gift.

AND/OR - A current gift through one of the tax advantaged means described on our website with a binding value of at least $5000.

Can I designate my gift to go to a specific cause I care about, or name my gift?

Can I designate my gift to go to a specific cause I care about, or name my gift?

- Gifts of less than $5,000 go into our general operating account to support NSS’ many programs in education and policy to advance our future as a spacefaring society.

- Gifts and bequests of $5,000 or more are allocated between the NSS Investment Account, which is designed to generate funds for major near term projects, and the NSS Endowment Fund, which is being grown to provide supplemental funding for our programs in perpetuity.

- In certain circumstance, dedicated and/or special named accounts can be set up for gifts and bequests of significant size.

The Gerard O’Neill Voyagers Circle Members

|

Chantelle Baier |

Art Dula |

Carol Redfield |